Over 16 million Americans depend on PG&E’s energy grid. How does one of the country’s biggest energy companies manage capital projects for its electric transmission system?

Todd Mintzer is the Senior Manager of the Electric Transmission Work Portfolio department at Pacific Gas & Electric Company, one of the largest combined natural gas and electric companies in the United States. After nearly a decade in the environmental and American integrated steel industries, Todd transitioned into the energy industry, where he is now part of a team that oversees the management of a ~$1.5 billion portfolio of hundreds of capital projects.

Todd Mintzer is the Senior Manager of the Electric Transmission Work Portfolio department at Pacific Gas & Electric Company, one of the largest combined natural gas and electric companies in the United States. After nearly a decade in the environmental and American integrated steel industries, Todd transitioned into the energy industry, where he is now part of a team that oversees the management of a ~$1.5 billion portfolio of hundreds of capital projects.

Over the past few years, Pacific Gas & Electric Company (PG&E) has reimagined and retooled the way we manage our portfolio of capital projects. We have always had a reliable process in place, but like many capital project organizations we struggled at various times with project churn, schedule compression, fragmented change control processes and challenging cash flow forecasts. We wanted to be more efficient and effective in executing our capital project plan.

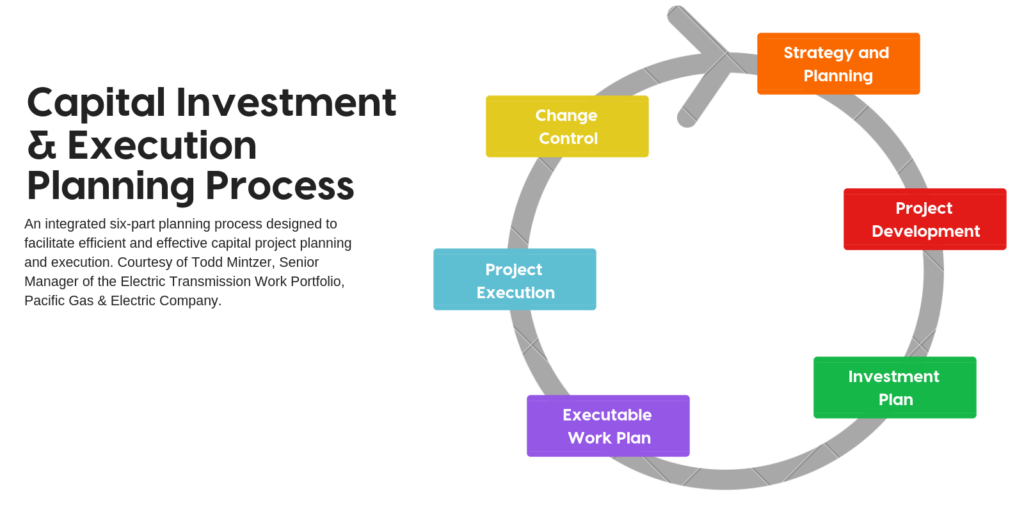

We conducted an in-depth review of our workflow processes, evaluating what was working best, and what we could do better. The result is an integrated six-part Capital Investment and Execution Planning Process, or CIE Process for short. Here’s a brief overview and introduction to the six parts.

Overview

At PG&E, a big part of what we do is managing the electric grid. Our mission is to safely and reliably deliver affordable and clean energy to our customers and communities every single day, while building the energy network of tomorrow.

Ultimately, the long-term objective of our CIE process is to ensure that, within Electric Transmission, we are effectively executing a strategy aimed at achieving this mission. This objective is ultimately achieved via the optimization and integration of each of the six process components covering the work in our capital project portfolio. Our efforts in this space allow us to maintain a continuously-balanced five-year capital project work plan.

Part 1: Strategy and Planning

In the Asset Management department, we monitor the condition and effectiveness of our grid assets, including substations, lines, transformers, switches, relays, towers, circuit breakers, and power poles. We are constantly working to understand the condition of the assets, and our related customer load profiles, so that we always have a clear idea of what we will need to do to the grid over the next five to ten years in order to execute our mission. In this part of the process, we want to make sure the strategy is being developed and vetted, and that we have a clear set of “needs” coming out of it — discrete pieces of asset-centric work required to maintain and, where needed, improve the transmission system.

For us — and for any capital project portfolio — all work must be aligned with a strategy. You need to understand why a company does the work that it does. Without an aligned and connected strategy, it is difficult to ensure that you are executing a work plan that aligns with your mission.

Part 2: Project Development

The next step is to begin the development of projects that will be used to carry out the strategy. To do this, we take the “needs” and bundle them together into projects. The goal is to gain efficiencies by combining work where it makes sense to do so.

At the same time we develop, for the first time, a high-level project scope, which we call the Project Development Scope. To ensure completeness, we use a set of checklists, we conduct table-top meetings, and we bring in stakeholders from different parts of the business who will be responsible for executing the project to collaborate with Asset Managers. The primary focus in this step is projects that will start in the sixth year, so that as time progresses, we are able to maintain a detailed work plan for each of the five years in our capital project portfolio. The table-top process for each project takes about 30 to 45 minutes, depending on the size.

Coming out of these meetings, we not only have our Project Development Scope, we also have an Advance Authorization – which is the first time we authorize a portion of the actual project. We also select and configure one of our two dozen template-based cost and resource loaded schedules for the first time. Our templates are based upon historical information. This template approach enables us to generate initial estimates for activities, sequences, dates and dependencies together with costs, labor demand, material demand, and overheads. One of the outputs of a cost and resource loaded schedule is a Project Forecast, that provides a monthly cash flow component extending out to the fifth year.

Part 3: Investment Plan

All of the Cost and Resource Loaded Schedules are then rolled up, and become the basis of our Five-Year Investment Plan — a five-year capital project portfolio. Critically, this process must align the highest priority work in the capital project portfolio with the resources available to execute it.

At PG&E, we employ a risk-based framework and scoring system to ensure that our investments are aligned with achieving our strategic drivers. Each piece of discrete work is evaluated and receives a score that reflects how effectively it achieves our strategy. Then, given the financial, labor, material, and other resources that are available, we use the methodology to draw a “cut-line” in our portfolio for each year. Work that is around and below the cut line is carefully evaluated, and if it is determined to be below the cut line, it is deferred into the future or cut altogether.

Given that 80% of our work plan consists of multi-year projects with a number of internal and external dependencies, we maintain a balanced five-year capital project plan because, collectively, we need to understand the impacts of future, multi-year projects on the immediate work plan. If we do not have a clear picture of what we are going to be delivering on three, four or five years down the road, we will undoubtedly encounter unanticipated impacts in the near-term which can generate a lot of churn because we are being reactive, instead of proactive. Not having a multi-year plan also tends to generate a lot of execution risk, because the unforeseen work is added to the near-term plan, the timing of that work is often compressed.

Step 4: Executable Work Plan

A three-year executable work plan ensures that the work we are seeking to accomplish is aligned with real-world constraints. Each project in our three-year portfolio is compared to a compression standard, which essentially tells us how long work should reasonably take under ideal circumstances, but which also includes a bit of breathing room, or float, between the various steps. When we check projects against the compression standard we can determine whether they are executable or not. Projects that are not executable are put on an action plan list, and they are subject to regular review by both those responsible for execution and their supporting leadership.

As a part of the Executable Work Plan, we also ensure that we have adequate resources in place, and that those resources are balanced – ie. Labor assigned to the projects in the plan are scheduled to work appropriate levels of overtime. If we find that we do not have enough resources in place, we make sure to move work to external resources and get any necessary contracts in place.

Step 5: Project Execution

This step is where we execute the work. We have established the portfolio of projects that makes up the three-year Executable Work Plan, and we are ready to go out and execute those projects. At the 30,000-foot level we ask two key questions — one forward-looking and one in the rear-view mirror: Are we prepared to start construction on time? Are we executing our work plan?

Today, the CIE process is mainly forward-looking. We spend more of our time asking: Are we ready to execute the work that is coming up next? A key component of this is our Construction Readiness analytic. The goal is to be in high-readiness a full 90 days before the start of construction. This means that we have all dependencies cleared on the project in order to start the construction phase, which is the most resource-intensive phase. If we do not have those dependencies cleared, the project goes into a low-readiness state, where it receives additional leadership attention and support.

The cost and resource loaded schedule is a key tool here. The project managers use these schedules throughout project execution, so that as dependencies are cleared, they are reflected in the system. In addition, we have a standardized set of common milestones for every project — including things like scope approval, design completion, receipt of permits, and long lead-time materials ordered. Project managers keep the status updated on all these milestones as they manage their work. At the portfolio level, this enables a clear view of project progress at all times.

Step 6: Change Control

Change control is about course-correction. At PG&E, we employ both project-by-project and portfolio-level versions of change control. At the project level, if there are any changes that impact scope, cost, or schedule, we ensure that those changes go through an approval process that requires all members of the collective project team — including the sponsor — to sign off. That process is how the appropriate levels of leadership can ensure that the decisions being made on each project are in the best interests of PG&E.

Then, at the portfolio level, we are able to review the collection of all changes and the related impacts to macro-level items, like the impacts on our collective budget. If we are short on resources, or vice versa, we can direct efficient changes in our capital project portfolio work plan, or we can signal to our partners in other parts of the company that we have extra resources or need additional resources. This step is also where we manage things like portfolio level risks and mitigation.

Now we have come full circle with the CIE process. All changes to the capital project portfolio get fed back into the start of the process, where Strategy and Planning can then make course corrections. Collectively, having an integrated Capital Investment and Execution Planning process enables Transmission Operations to effectively execute a strategy aimed at achieving PG&E’s mission.